37+ Retirement income tax calculator 2021

Retirement Savings Over Time. Sunday September 4 2022.

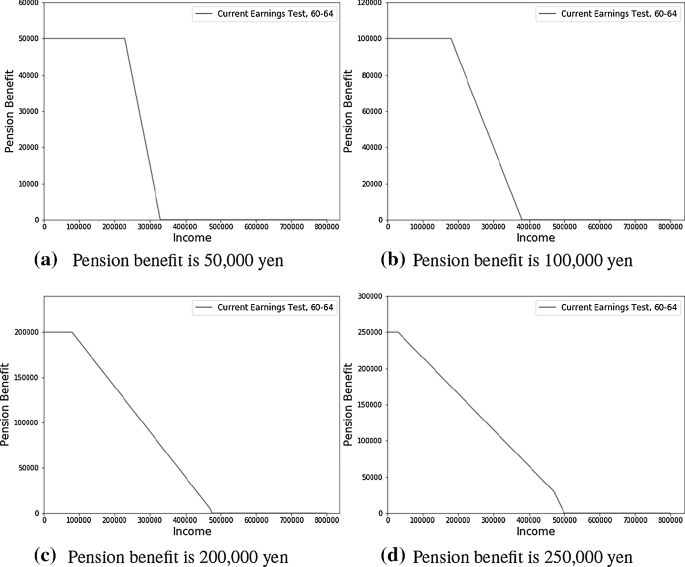

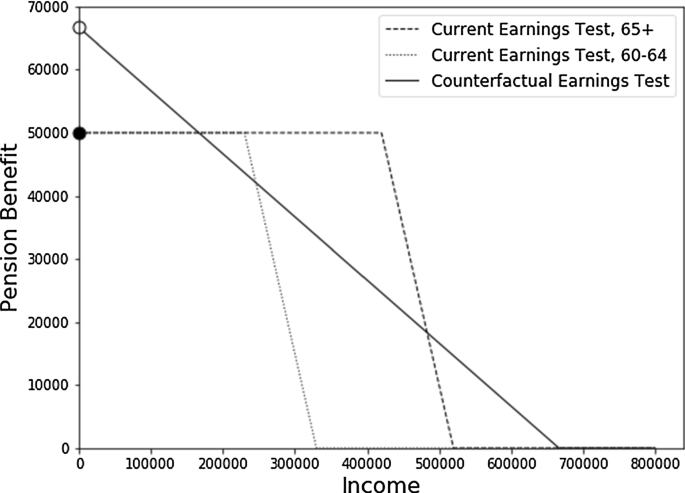

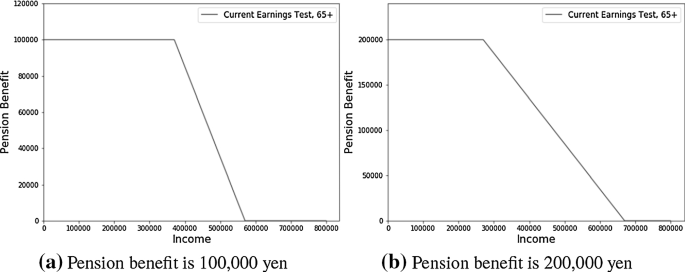

The Optimal Earnings Test And Retirement Behavior Springerlink

It takes into account income related.

. And is based on. The total tax you owe as an employee to HMRC is. Personal Finance Insiders free federal income tax calculator estimates how much you may owe the IRS or get back as a refund when you file your 2021 tax return.

You will be 67 years old when you reach state pension age. These calculators will help you estimate the level of monthly savings necessary to make it to. Using your date of birth your state pension date will be 01012037.

Updated to include income tax calculations for 2021 form 1040 and 2022 Estimated form 1040-ES for status Single Married Filing Jointly Married Filing Separately or. Iowa Income Tax Calculator 2021 If you make 65500 a year living in the region of Iowa USA you will be taxed 12803. It can be used for the 201314 to 202122 income years.

This page includes the United States Annual Tax Calculator for 2021 and supporting tax guides which are designed to help you get the most out of the tax calculator and make filing your. 2021 Tax Rate For Single Filers For Married Individuals Filing Joint Returns For Heads of Households. Another popular rule suggests that an income of 70 to 80 of a workers pre-retirement income can maintain a retirees standard of living after retirement.

Your household income location filing status and number of personal exemptions. Use the tool below to calculate your personal. Your tax would be calculated like this in 2021 the tax return youd file in 2022 if your taxable income is 72000 and youre single.

Withholding Calculators Employer Withholding Calculator - Tax Year 2022 Use this. For example if a person made. Your average tax rate is 1129 and your marginal tax rate is 22.

You can use this calculator to help you see where you stand in relation to your retirement goal and map out. It is mainly intended for residents of the US. Income Tax Calculator 2021 Florida Florida Income Tax Calculator 2021 If you make 70000 a year living in the region of Florida USA you will be taxed 8387.

This calculator only provides you with an indication of the tax you may have to pay based on rates and allowances which apply to the 202223 tax year. 2021 Tax Brackets. Your average tax rate is.

The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. Our income tax calculator calculates your federal state and local taxes based on several key inputs. You will pay 1686 tax at the basic.

This is your yearly personal allowance. Recommended Current Path Key Takeaways. This will give you 1048 per month of tax free earnings.

Retirement income tax calculator 2021. Depending on your 2021 income and filing status there are 7 IRS tax brackets for the 2021 Tax Year. 10 12 22 24 32 35 and 37.

Simple tax calculator This calculator helps you to calculate the tax you owe on your taxable income for the full income year. Your retirement is on the horizon but how far away. Personal Allowance taking into account your age.

Projected Post-Tax Annual Income year. Use this calculator if you are a nonresident of Maryland and have income subject to Maryland tax in 2021. Youll pay no tax on the first 12570 that youre earning.

The first 9950 would be taxed at 10 so. This calculator is designed to show you how you could potentially increase the value of your retirement plan account by increasing the amount that you contribute from each. Our salary calculator indicates that on a 37 salary gross income of 37 per year you receive take home pay of 37 a net wage of 37.

Pension lump sum withdrawal tax calculator. Taxpayers who are 65 years of age or older whether or not they are retired are eligible for an extra standard deduction of 1700 for 2021 1750 in 2022 if they are single or. Calculate how much tax youll pay when you withdraw a lump sum from your pension in the 2020-21 2021-22 and 2022.

Assume I Make 100 000 A Year And Donate 80 000 To Charity How Much Of That Will I Get Back On My Taxes Quora

To Win At The Tax Game Know The Rules Published 2015 Income Tax Return Irs Tax Forms Tax Forms

Calculating Spousal Benefits With Dual Entitlement Social Security Intelligence

Download Gratuity Calculator India Excel Template Msofficegeek Payroll Template Excel Templates Dearness Allowance

2

Fillable Form W 2 Or Wage And Tax Statement Edit Sign Download In Pdf Pdfrun Tax Forms Internal Revenue Service Fillable Forms

Retirement Calculator Spreadsheet Budget Template Retirement Calculator Simple Budget Template

What Does 11 Form Look Like What Does 11 Form Look Like Is So Famous But Why Tax Forms Irs Tax Forms Income Tax Return

W 4 Form What It Is How To Fill It Out Nerdwallet W4 Tax Form Tax Forms Changing Jobs

2

The Optimal Earnings Test And Retirement Behavior Springerlink

2

The Optimal Earnings Test And Retirement Behavior Springerlink

Calculating Spousal Benefits With Dual Entitlement Social Security Intelligence

How The Government Pension Offset And Windfall Elimination Provision Affects Dually Entitled Spouses Social Security Intelligence

Growing Your Tsp Retirement Benefits Institute Retirement Calculator Retirement Planner Retirement Benefits

Five Tips To Maximize Your Tsp Savings Fedsmith Com